Your basket

Your basket is currently empty.

£-1.00

£-1.00

Why Do Tampons Cost So Much?

Share

Why Do Tampons Cost So Much?

Making Sense Of The Tampon Tax

Illustrations by

Erin Rommel

Date

2nd September 2019

What is the tampon tax?

The “tampon tax” is the amount of money consumers are taxed when buying sanitary products, including tampons, pads and panty liners. Although it’s gained infamy as the “tampon tax”, it’s technically the Value Added Tax, or VAT.

The UK first introduced VAT when it joined the European Economic Community (which eventually became part of the European Union) in 1973. Over the years, the rate of VAT has changed, going from an initial 10% to 8%, then up to 17.5%, and finally to the standard default rate of 20%.

The standard 20% VAT applies to most goods and services, but some products are charged at a reduced rate of 5%, including sanitary products. Tampons and pads used to be standard-rated, but in 2000 Labour MP Dawn Primarolo convinced Government to bring the rate down to a discounted 5%, which is currently the lowest rate possible under the EU's VAT rules. So, if tampons are subject to the lowest VAT, why all the fuss around the tampon tax?

While a reduced tax fee is definitely better than the full 20%, it’s fair to question why tampons are even taxed in the first place. Some products are completely exempt from VAT, for example most children’s food and clothes, and bizarrely cakes and biscuits too. If a cake can be zero-rated, why not tampons—which so many people rely on every month? The real issue here is that tampons are classified as “non-essential”, “luxury items”. But anyone who menstruates knows damn well having a period is not a luxury.

Why tampons are classified as “luxury items”

Many believe the tampon tax is an arbitrary act of misogyny, one of the many punishments we have to face for having a uterus—it’s even often referred to as the “tax on women”. That’s not entirely correct, although people with a uterus definitely get the sh*t end of the stick most of the time.

While there’s no denying that the tampon tax is unfair, sanitary products aren’t taxed as a luxury simply because regulators have it out for us (but some probably do, let’s be honest). Tampons are classed as a luxury because it costs very little to produce them and have a very high profit margin, which is the amount by which revenue from sales exceeds costs. In that sense, they’re like a Balenciaga hoodie… except you’d never use a Balenciaga hoodie to soak up menstrual blood.

“Many wrongly assume that tampons being taxed as luxury goods is a sexist act on behalf of governments,” explains Valentina Milanova, Daye’s Founder & CEO. “In fact, governments decide how to tax a good based on its profit margins. The reason why governments tax goods differently is to attempt and capture some of the excess profit margins from what are traditionally defined as luxury goods. The policy rarely works, as luxury goods often come in short supply, and are manufactured in little to no competition, which is why brands are able to pass the higher tax governments ask them to pay to consumers.”

Essentially, tampons generate a lot of revenue for those who manufacture them, and people who menstruate are the ones who have to cash out because big brands are profiting. Capitalism, eh?

“There is a very limited number of companies focusing on tampon manufacturing, and only one company that produces all tampon-making machines globally,” adds our founder. “This lack of competition and varied supply means that as a whole, the industry is able to extract significant profit margins from the products it makes.”

The high cost of sanitary products also means anyone living below the poverty line is unable to afford them, and according to Plan International UK, 1 in 10 girls have been unable to afford sanitary products, often having to use socks or newspapers instead. Period poverty doesn’t just affect quality of life, it also means people’s education and well-being are affected, so it’s imperative that period care be financially accessible to everybody.

“

Anyone who menstruates knows damn well having a period is not a luxury.

The tampon tax in the UK

There has been significant progress in ending the tampon tax. Following public outrage and a viral petition, in 2016 the UK Government committed to slashing the 5% tax… as soon as legally possible. The European Commission (the executive branch of the EU) has reformed to law that would allow the UK to zero-rate tampons, but that won’t come into effect until 2022. Since the EU has the last say on whether or not VAT can be removed from tampons, it begs the question: how will Brexit affect the tampon tax?

The term “Brexit” elicits many feelings: dread, fear, the need for a drink… but it’s not something you’d associate with periods. And yet, the fate of Brexit will influence the cost of tampons. The EU controls taxation across all its member states, so in order for the tampon tax to be axed we need to either wait for the EU to remove it, or wait for Brexit to happen. The Government guarantees that will happen in 2022, but it’s unclear how realistic a goal that is. Once we’ve left the EU (*sobs*), the UK will be able to implement its own national taxation policies, including those affecting sanitary products.

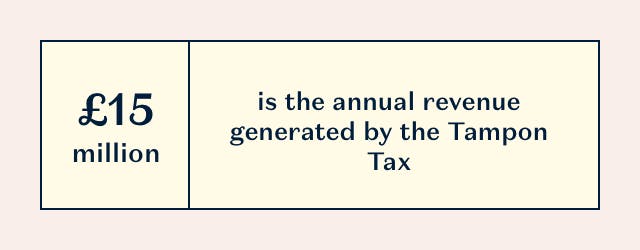

Until then, anyone who uses disposable sanitary products will have to keep paying up and contributing to the £15 million that the tampon tax generates in annual revenue. While the UK isn’t able to axe the tampon tax quite yet, since 2016 Government has distributed the money generated from the tampon tax (known as the Tampon Tax Fund) to subsidise several women’s charities across the country. Unfortunately, that included allotting £250,000 to an anti-abortion group.

Supermarket chains like Tesco, Co-op, Morrisons and Waitrose have also pledged to help, paying the 5% VAT on behalf of customers, reducing the price of tampons and pads to reflect the tax fee.

The tampon tax and Daye

As tampon manufacturers, we’re not barred from having our tampons classified as luxury goods. Even though Daye tampons come at a premium to reflect the true cost of sustainability and sanitisation (higher standards means higher costs), they’re still subjected to a 5% VAT. We realise this isn’t fair for those who rely on our product, so we reinvest those profits into continuous research and development.

We’re the first tampon company to conduct extensive clinical studies on our tampons, as well as continuously conducting material innovation and analysing the life-cycle of our packaging to ensure it’s as sustainably as possible. By buying Daye tampons, you’re helping develop and improve on a product that is safe for your body and the environment.

TL;DR

- The “tampon tax” is the name given to the 5% VAT tampons, pads and liners are subjected to.

- Tampons are classified as a luxury item because they have a very high profit margin (which means they’re cheap to produce, but generate a lot of revenue).

- The UK government has promised to scrap the tampon tax, but that likely won’t happen until 2022.

- At Daye we reinvest the revenue from the 5% VAT into continuous R&D.